How Much Do You Need To Make To Afford A Sports Car

Buying a car is a major purchase, and for many people, it’s likely the most expensive asset that they will own (aside from a home). With this in mind, buying a car should be approached as a calculated decision.

So, how much do you need to make to afford a sports car? That answer depends on many factors, such as:

- Price of The Vehicle - Higher prices will likely require financing with specific monthly payments.

- Auto Loan Rate - Different financing lenders will offer different rates.

- Length of Loan - The longer the loan, the less your monthly payment will be.

- Cost of Insurance - The type of car you choose, driving habits, demographic, and coverage all affect your rate.

- Cost of Gas - The type of car and your region will affect your costs differently.

- Cost of Maintenance - Sports cars and luxury brands may require more frequent maintenance and higher parts costs.

Depending on how conservative you want to be with your finances, there are three calculations you can use in determining how much you need to make to afford a sports car.

Once you've chosen the calculation you'll use, you can figure out how much you need to make to afford the sports car of your choice, or skip to the section below where we have calculated that for you.

In this article (Skip to…)

- 3 Rules of Thumb (to calculate how much you can afford)

- How Much You Need To Make (To Buy A Sports Car From $10k-$100k)

3 Rules of Thumb

Below you’ll find three calculations, ordered from most conservative to least conservative, to help you find the appropriate budget for your car and how much you need to make.

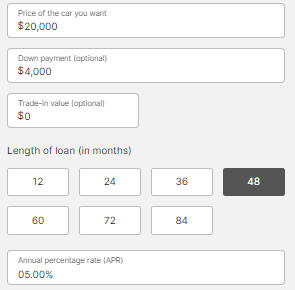

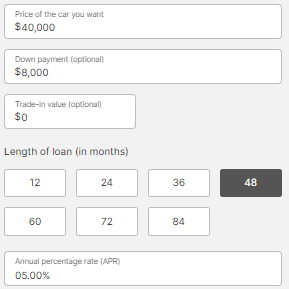

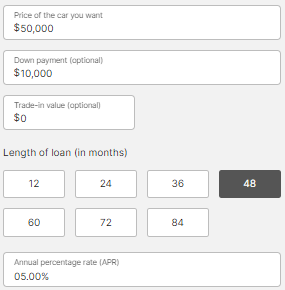

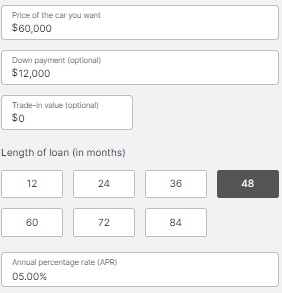

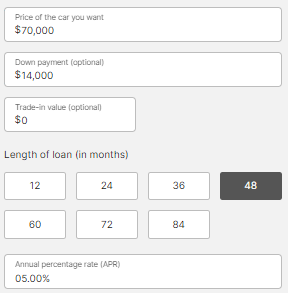

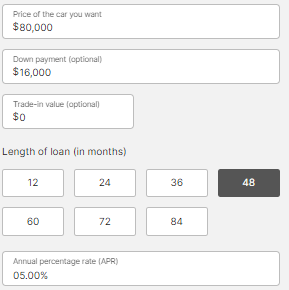

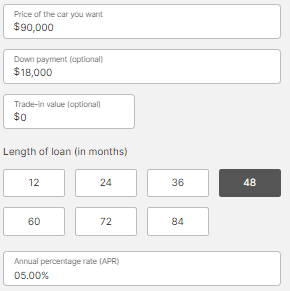

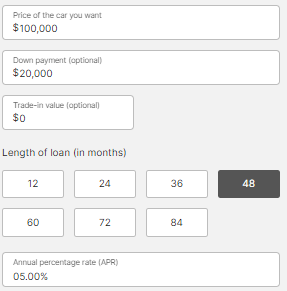

20/4/10 Rule

This rule is the most conservative and the most recommended approach people should use to figure out their car budget.

It assumes that you have money to put down and that you’ll also use financing (but you can always play around with the numbers depending on your scenario).

The 20/4/10 rule states:

- Put down 20%

- Finance it for 4 years (48 months)

- Monthly car, insurance, and gas payment of no more than 10% of your income

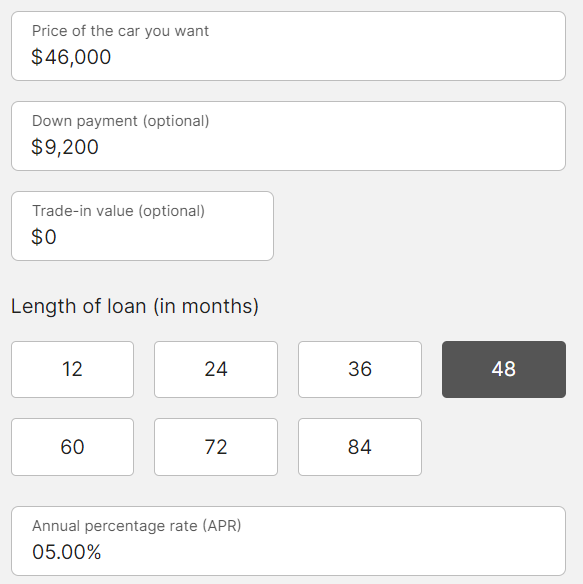

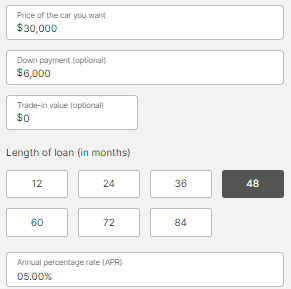

Use the following calculator to test this out.

As an example, let’s say you want to buy a Tesla Model 3 worth $46k

You’ll need to put down 20% of that price, or $9,200.

You’ll finance it for 48 months, or 4 years, at an average auto loan rate of 5% (this figure can be changed once you get your loan terms).

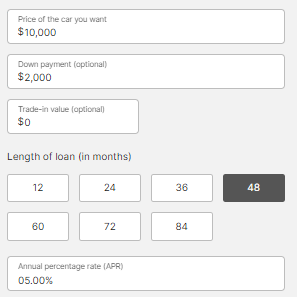

With those numbers, your monthly payment is $847.

According to MoneyGeek, the average cost of insurance for a Tesla Model 3 is $142 per month.

Add $847 and $142 together and you get a $989 total car monthly estimated expense.

Since your car should not be more than 10% of your monthly take home, you’ll need to make about $118k per year (before taxes) to comfortably afford this Tesla.

This is a very conservative approach and it's meant to be that way so you can also balance your other expenses and fund your retirement without over-extending yourself.

Balance Sheet Approach

Popularized by Dave Ramsey, this approach is for those who also want to be conservative with their finances but keep their calculations simple.

The balance sheet approach states that the cost of a car should not exceed more than 50% of your annual income.

As an example, if you make $100,000 per year, the car you can afford is no more than $50,000.

For some, this rule can seem a little bit too restrictive.

Recent 2022 data from Kelley Blue Book shows that the average price for a new vehicle is above $47,000, so that means people need to be making at least $94,000 to afford an average new car with this rule.

When you look at the US Census, it shows the average annual household income is only $67,000, so the average person should only be able to afford a car worth $33,500!

And in the case of you wanting to buy that $46k Tesla Model 3, well you’ll need to make at least $92k to afford this car using this approach.

20% Rule

Another one of the most common approaches many people use to figure out a car budget is the 20% rule.

The 20% rule states that 20% of your monthly after-tax pay can be used on your car.

The rule comes with a caveat—the 20% should also include the cost of gas, insurance, and maintenance for your vehicle.

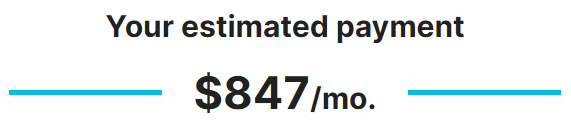

As an example, let’s say you make $100,000 per year. Depending on local taxes and deductions, you should be taking home about $5,600 in after-tax income per month.

Using that after-tax figure, the 20% rule states that you can realistically afford a $1,120 monthly car cost. Sounds a lot better than the other rules, right?

Plug it into a car affordability calculator with your expected down-payment and financing terms and you should get the figure for the price of car you can afford.

With this less conservative 20% rule calculation, I got a range of $59k-$66k I can use to purchase a sports car if I make $100k a year.

Compare that to the balance sheet approach, which only states I can afford a $50k car with a $100k annual income.

Then compare both of those figures to the 20/4/10 rule, which says you can only afford a $40k car if you make $100k a year.

How Much You Need To Make To Afford A Sports Car

According to Policygenius, the average cost of full-coverage car insurance is $1,652 per year, or $137 per month.

We’ll be using the $137 per month average insurance cost and the 20/4/10 rule to calculate the amount you need to make to afford different priced sports cars below.

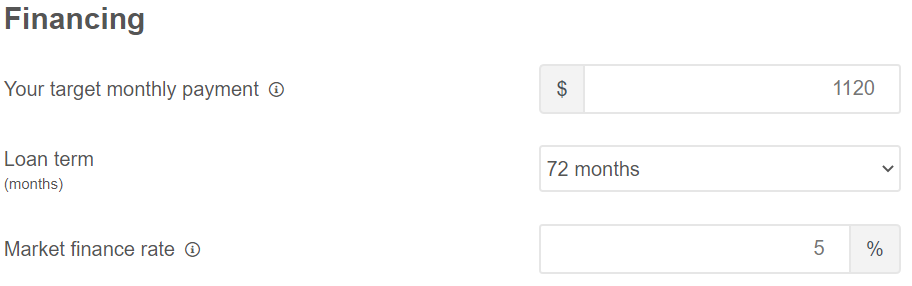

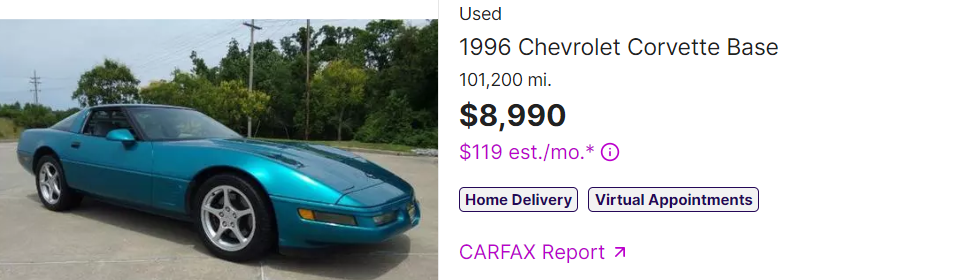

How Much Do You Need To Make To Afford A $10k Sports Car?

You'll need to make $38,520 to afford a $10,000 sports car using the 20/4/10 Rule.

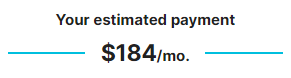

We calculated this by adding our estimated payment of $184 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $3,852.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $38,520.

Although you probably should not finance a car this old and worth this much, a good starting sports car at this price range is the Chevrolet Corvette:

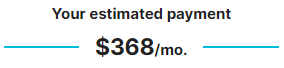

How Much Do You Need To Make To Afford A $20k Sports Car?

You'll need to make $60,600 to afford a $20,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $368 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $6,060.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $60,600.

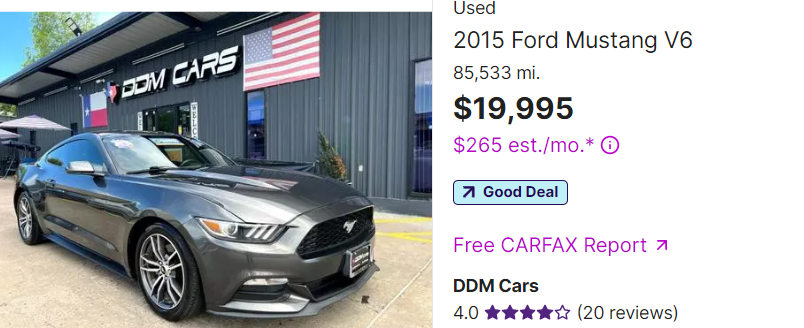

The $20k price range opens you up to a lot of potential sports cars, such as this V6 Ford Mustang:

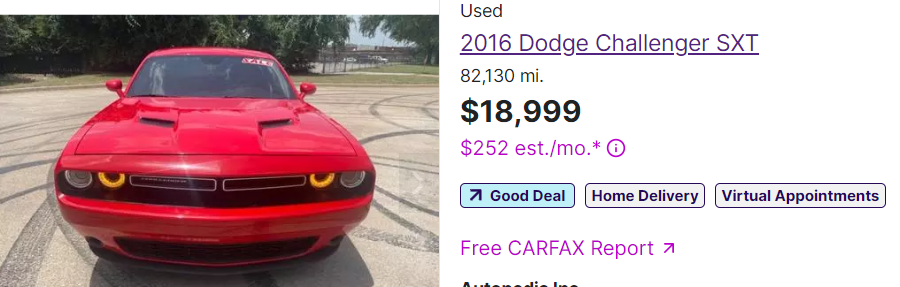

You can also get yourself into a similarly-aged car such as the Dodge Challenger SXT:

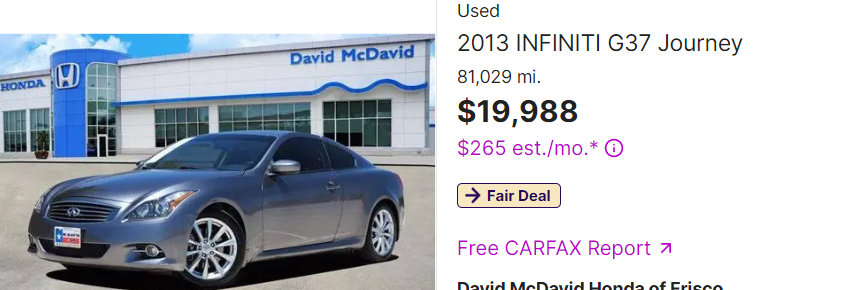

Or look at the Japanese automakers and land yourself in this Infiniti G37

How Much Do You Need To Make To Afford A $30k Sports Car?

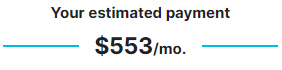

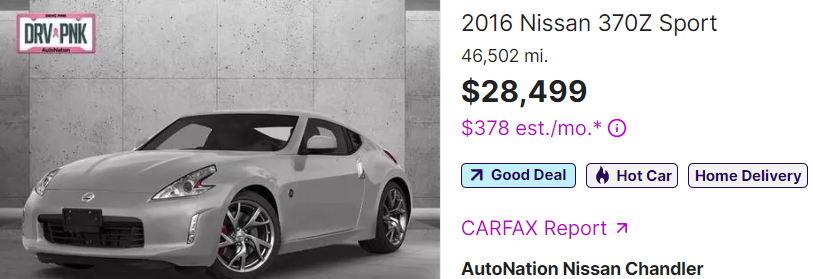

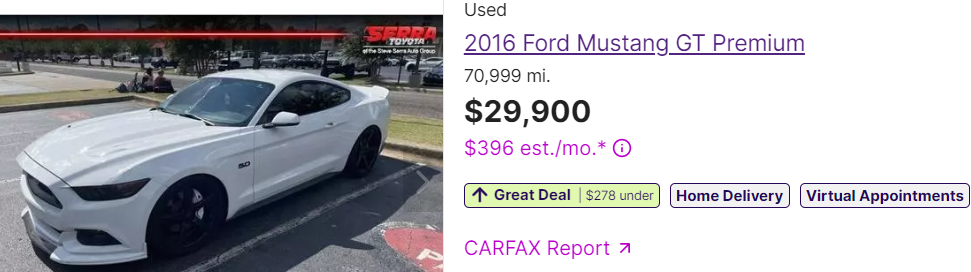

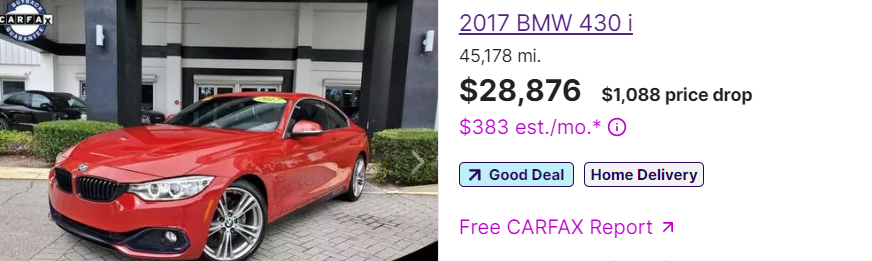

You'll need to make $82,800 to afford a $30,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $553 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $8,820.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $82,800.

At the $30k price range, you'll find a lot of options for a decent sports car, like this Nissan 370z:

You can also get something a little bit more powerful like this 5.0 Mustang GT:

Or start dabbling in some European options like this BMW 430i:

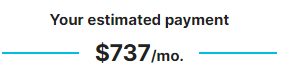

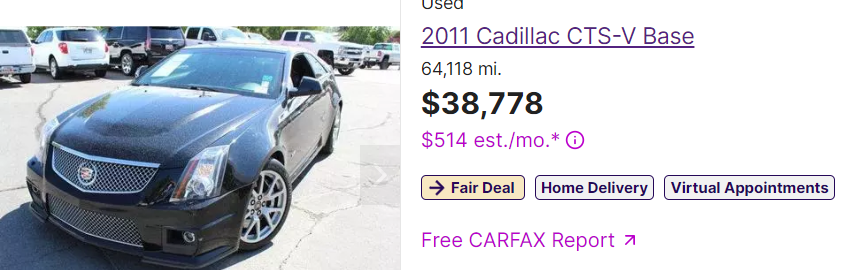

How Much Do You Need To Make To Afford A $40k Sports Car

You'll need to make $104,880 to afford a $40,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $737 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $10,488.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $104,880.

At $40k you can start getting into some heavy-hitters, like this Cadillac CTS-V:

Or this soon-to-be-classic BMW M3:

How Much Do You Need To Make To Afford A $50k Sports Car?

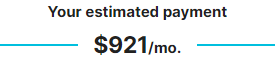

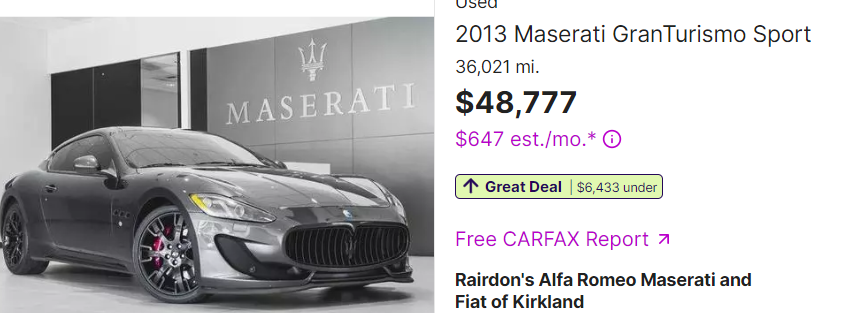

You'll need to make $126,960 to afford a $50,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $921 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $11,052.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $126,960.

At $50k for a sports car, you really start to open up some of the nicer options, like this Maserati GranTurismo:

Or this Chevrolet Corvette C7 Stingray:

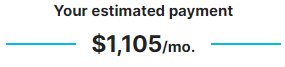

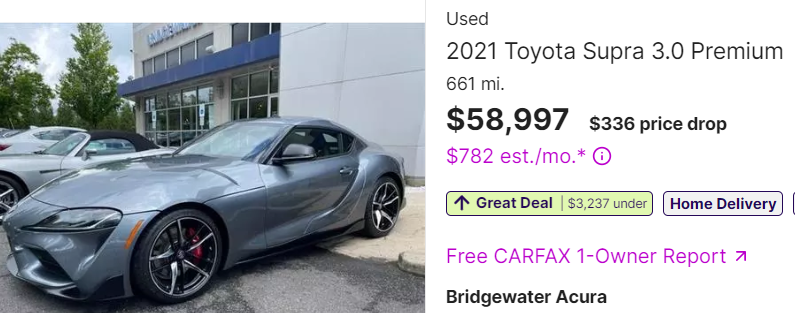

How Much Do You Need To Make To Afford A $60k Sports Car?

You'll need to make $149,040 to afford a $60,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $1,105 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $14,904

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $149,040.

At $60k, you can get a near-new condition Toyota Supra:

Or find yourself in one of current car culture's most desired cars, a near-new Challenger Scat Pack:

How Much Do You Need To Make To Afford A $70k Sports Car?

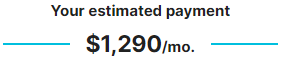

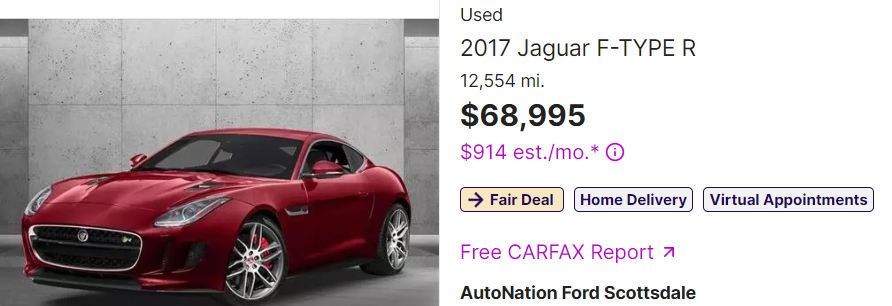

You'll need to make $171,240 to afford a $70,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $1,290 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $17,124

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $171,240.

At a $70k price for a sports car, you can find yourself in a Jaguar F Type R:

Or a near-new Audi RS5:

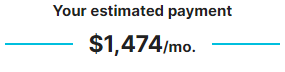

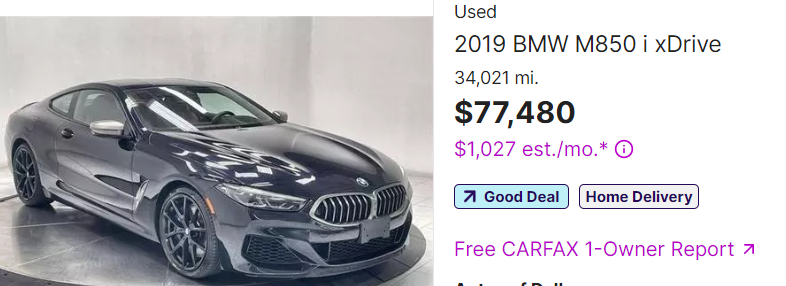

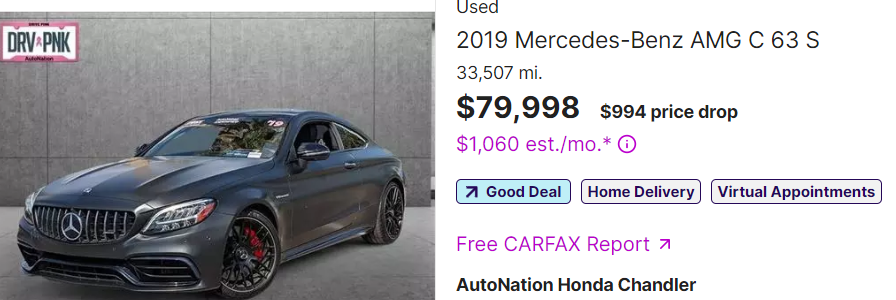

How Much Do You Need To Make To Afford A $80k Sports Car?

You'll need to make $193,320 to afford an $80,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $1,474 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $19,332

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $193,320.

At $80k pricing, you can find some of the European powerhouses like this BMW M850:

Or this Mercedes-Benz AMG C 63 S:

How Much Do You Need To Make To Afford A $90k Sports Car?

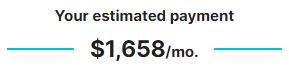

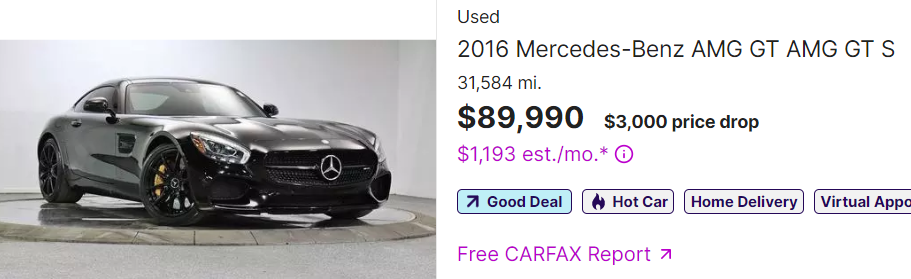

You'll need to make $215,400 to afford a $90,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $1,658 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $21,540.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $215,400.

At $90k for a sports car, you can find yourself in this Mercedes-Benz AMG GT S:

Or the brand new Chevrolet Corvette C8:

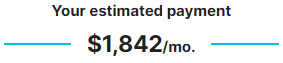

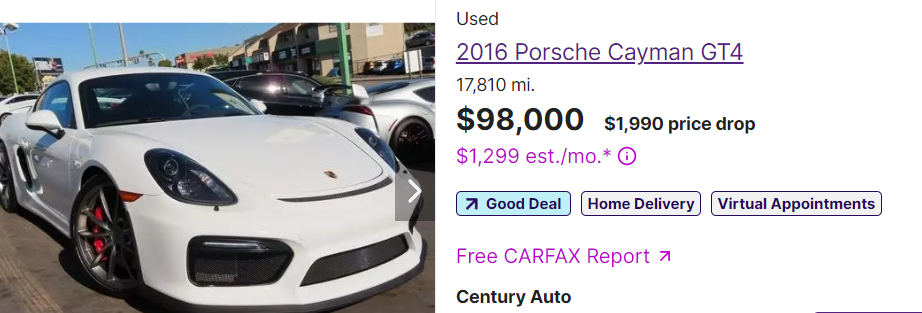

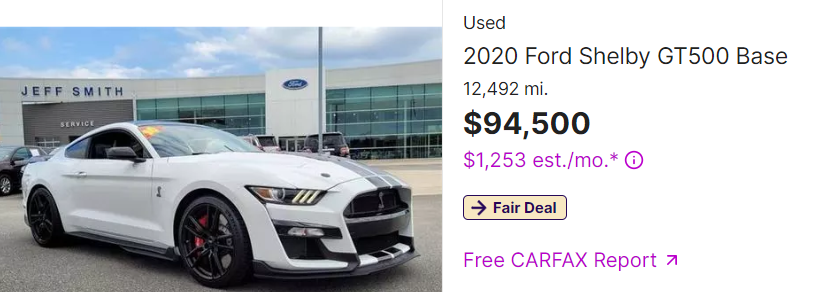

How Much Do You Need To Make To Afford A $100k Sports Car?

You'll need to make $237,480 to afford a $100,000 sports car using the 20/4/10 Rule.

We calculated this by adding our estimated payment of $1,842 with an estimated average insurance of $137.

Multiply that figure by 12 for each month of the year and you get $23,748.

Then multiply that by 10 so your car payment is only 10% of your monthly income and you get $237,480.

At $100k pricing for a sports car, your possibilities are endless. You can find yourself in this racing-derived Porsche Cayman GT4:

Or if you want all the horsepower ever possible, look no further than the Ford Mustang GT500:

Like what you just read? Feel free to share this with your friends or on social media to keep the conversation going.

See also: 8 Underrated Used Sport and Performance Cars Under $30k

Comments ()